Federal Reserve, US Monetary Policy, and the Magnificent Seven

...and also It's A Wonderful Life, Life With Father, and The Last Resort.

I have been hearing1 conflicting opinions about where our country is heading. On one side, the Biden administration is claiming that everything is fine. On another Republicans claim that we are heading into another recession and unless they take control of Congress, the US will be playing second fiddle to China. They warn against the New World Order and the Party of Davos.

If you have not heard of Davos, the WEF, or Klaus Schwab, watch this. It’s funny but true.

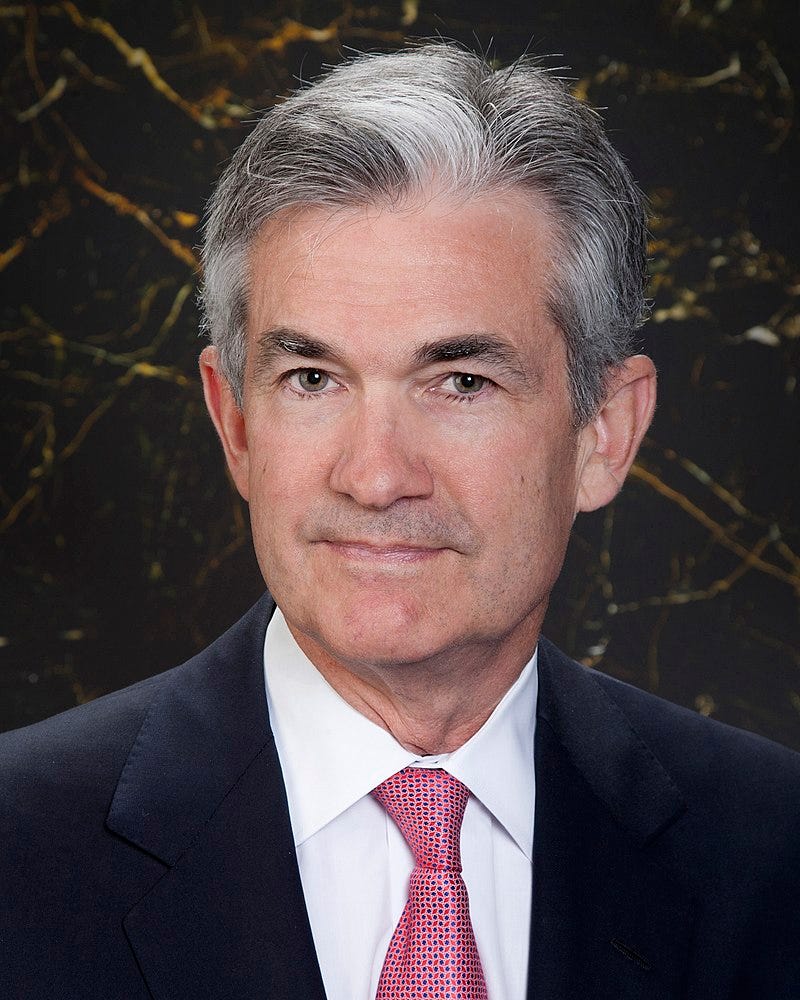

This is what most people have as their two sides. I have a third. It comes from a group of people who are pointing at the “Party of Davos” (who is focused on a New World Order, the Great Reset, and transhumanism) and saying that they are not in control, that they are failing, even though they have the *great* leaders of the world (US, UK, Germany, France, etc.) behind them. In their estimation, Klaus Schwab, George Soros, and Bill Gates are not the most powerful men in the world. It is instead a person called Jerome Powell.

Jerome Powell is the head of the Federal Reserve. He sets the monetary policy of the US. He is appointed by the President, but he is not controlled by him. The Federal Reserve is a private organization that is managed by a government appointee.

What I would like to ask in this article is: What is the Federal Reserve? How does the Federal Reserve control the dollar? How does the Federal Reserve control the monetary policy of not only the US but of the world? These are the questions I will investigate in this article. I will start by finding out what exactly is the Federal Reserve, and what they control.

For the record: I don’t own a credit card, have not taken out a mortgage on a house, and have never gotten a loan on a car. This article represents merely my research into the questions I just stated.

For right now I am not going to make an argument for or against the Federal Reserve. We will set aside (at least for a moment) the common arguments for the gold standard, privatized banking, and bitcoin. Right now, we are just looking at what banks do, what the Federal Reserve does, and what they are doing now.

Also, there are a lot of videos in this article for your edification. These are not necessary to understand what I am talking about. Often they are the ones that made me understand the concept myself. They are “extra credit”.

A quick banking recap…

In order to understand the broader global banking market, we need to recap the basic way a bank works.

If you are not familiar with this scene, watch it.

The basic principles of banking and liquidity are laid out well in It’s A Wonderful Life, which is a family favorite in the #whereisjohnfisher household.

It all starts when the Federal Reserve issues some brand new money. Lets imagine that you are given by the Fed $1000 (though this never happens, but bear with me). You then deposit that $1000 in your bank. The bank, then, will take that money and loan it to another person, keeping about 10% in their reserves. That person will then deposit that money in their bank. That bank will then loan out that money, and so on till there is no more. You still own your original $1000, but you don’t, in reality, have it. You write checks on it.

Extra credit.

If you demanded all your money in your bank in cash, the bank would not be able to pay it all. They have it loaned out to someone else. They will either call their loan on their debtor or borrow from another bank. If they cannot get the money, it might result in a bank run like the one in the movie above… but will George Bailey be there to calm things down?

It is a system that relies on trust in the banks. This system is called Fractional Reserve Banking. One of the Federal Reserve’s jobs is basically to stop bank runs from happening.

What is the Federal Reserve?

The Federal Reserve (also referred to as “the Fed”) is the central bank of the United States; they set monetary policy for the US, have the authority to issue money into the market, and regulate banking. You may have heard of the joke: Jerome Powell sneezes, and the market goes crazy. That is because the Fed has power. But what do they do?

The Fed is a private bank that serves as the middle man between the US Government and the rest of the economy. On one side, every US Bank that is regulated by the Fed is required to keep a certain amount of cash in their local Fed Branch (there are 12 main branches and many more sub-branches). They are, in return, granted a certain amount of stock in the Fed, which they are required to own. This stock pays a fixed 6% dividend. This gives private commercial banks a say in the Fed.

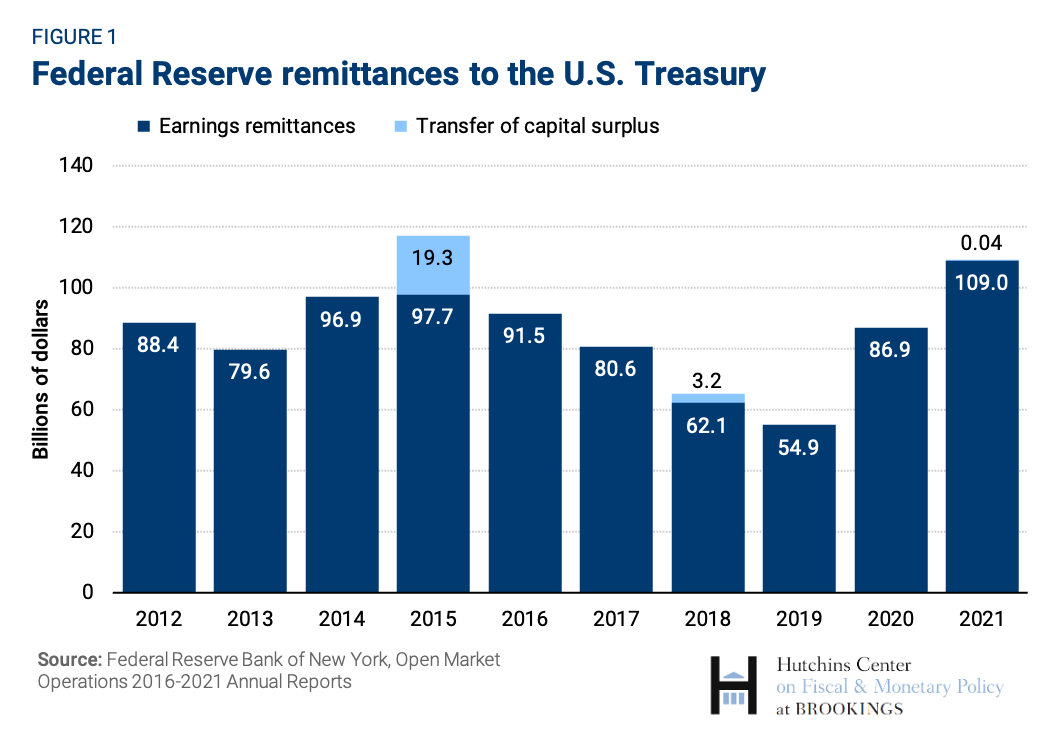

Oh, and don’t worry about the Fed paying that back. They are very profitable. In 2021, they made over $100 billion dollars in revenue. They manage trillions in assets on their balance sheet.

On the other hand, the Fed is governed by 7 governors which are appointed by the President, and confirmed by the Senate. Each governor has a 14 year non renewable term.

The Fed is headed by a chairman, who is one of the governors, and has a 4 year term as chair, which can be renewed.

This keeps the Fed from being fully public or fully private.

How is the Fed different from the Treasury?

First of all, the Fed is a private institution, while the Treasury is a department in the Executive Branch of the US government. The Fed controls facets of the overall US economy through interest rates. The Treasury is the part of the federal government that actually writes the checks and spends (at the behest of Congress, the Executive Branch, etc.).

Another way to think about it is that the Treasury issues US debt, and the Fed buys US debt on the open market.

Granny has a checkbook

An explanatory parable…

Granny has a checkbook. She buys everything with checks. Her grandson manages her bank account. He has to make sure there is actually something in her account so her checks don’t bounce.

The grandson goes to Granny, and tells her she has to stop writing checks. She is running out of money in her account.

“But I still have checks!” says granny, “Here they are in the book. I signed these checks!”

“But Granny, there is no money in your account. Your checks are not worth anything!”

“But the man at the bank said that I can write checks to buy things!”

“But there has to be something in your account!”

Granny is the Federal Government, the grandson is the Fed.

Just for fun.

What does the Fed do?

One thing the Fed is most well-known for is controlling interest rates. Whenever anyone wants to buy a house or car (or start a business, or anything else) with a loan, they borrow the money from the bank, who will get the money back plus a certain amount of interest. This can vary from 2-15% depending on multiple things.

This is where the Fed comes in.

The Fed controls the minimum required amount of money a bank must keep to pay its depositors. This money can be either kept in cash in a bank vault, or in the bank’s local branch of the Federal Reserve. Sometimes the banks are low at the end of the business day, so they often borrow money from other banks to keep up the balance. The interest rates for these loans are called the Federal Fund Rate, interbank rate or overnight rate, and the Fed controls what this rate is.

Historically, this rate has been influenced by the LIBOR (London Inter-bank Offer Rate), which is set by a group of 17 banks around the world. Recently, the Fed has moved to using SOFR (Secured Overnight Financing Rate), which is calculated by the New York Federal Reserve Branch.

Since they control the rates between banks, they indirectly control the rates between the banks and their customers.

The Fed uses this power to balance the market and keep a healthy monetary policy. When the economy is growing too fast, potentially creating instability, the Fed raises interest rates to combat all the extra money that is being moved, which may lead to inflation. Sometimes the Fed reduces interest rates to stimulate the economy when it falls apart. This was the case during the lockdown, when no one left their houses, cities, states, and countries to interact and participate in the market. Recently, the Fed has been raising interest rates to combat the threat of inflation.

Since the Fed is essentially able to control the price of money, they wield enormous power to keep the US economy and the world stable.

How does raising interest rates combat inflation?

Interest rates are basically the price of money. When you take out a loan, you are hiring money to work for you. Hopefully you can pay it back.

In the labor force, when there are more workers the price of labor is cheaper. In the monetary system, when there is more money the price of money is cheaper.

The Federal Reserve’s job is to control the growth of the economy. By lowering interest rates, the price of money decreases, more money changes hands, and the economy grows. By hiking interest rates, the price of money is increased, the velocity of the economy decreases, and the economy is slowed down.

How the Fed Controls the Dollar

Another thing that the Fed can do is control the money supply. They have multiple tools to do this. One way is just simply to issue more currency. We have seen that this can result in a lot more inflation than you would think, for if everyone is depositing this money in their bank accounts, the money can be reused (see above).

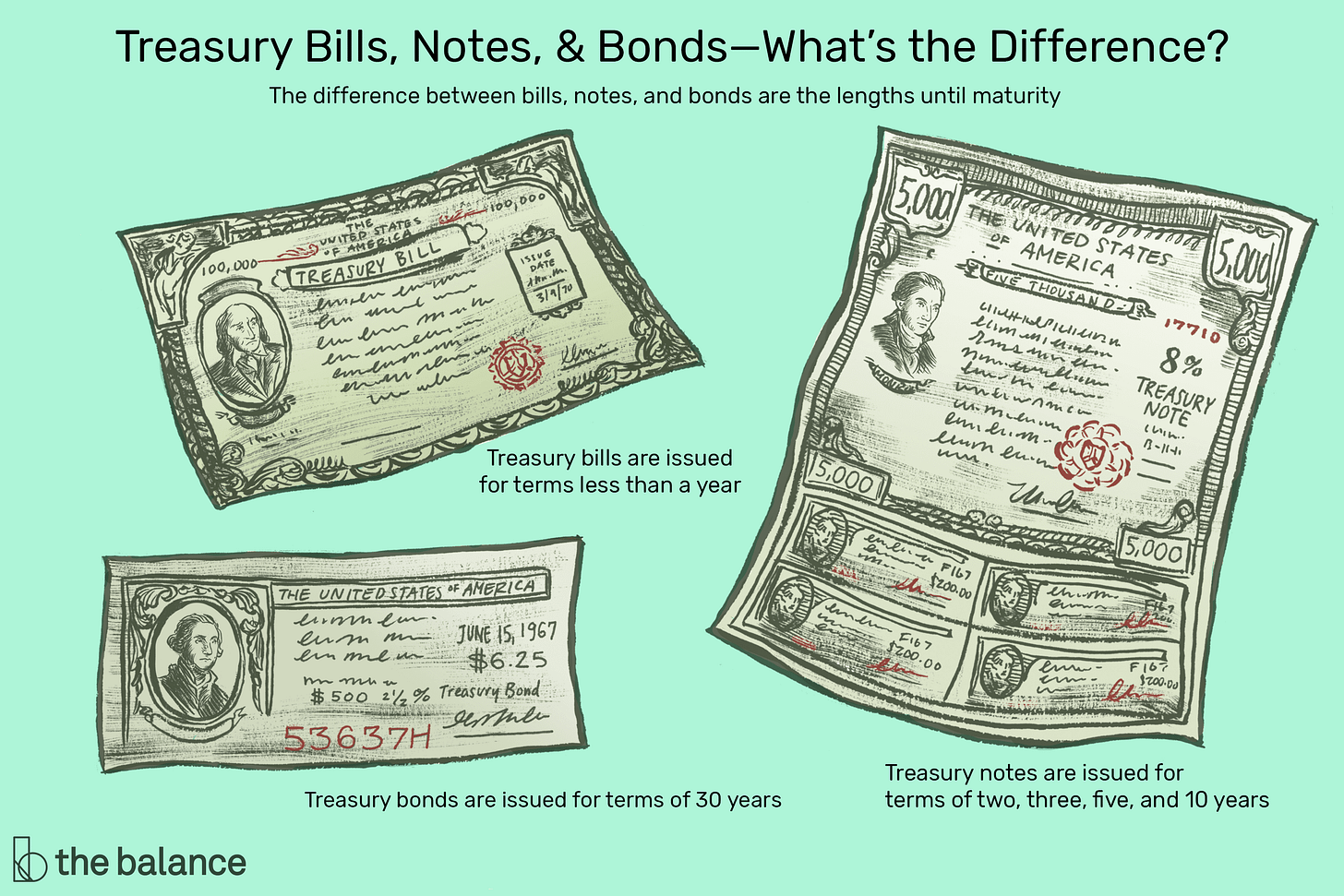

Another tool the Fed has to increase or decrease the money supply is to buy Treasury securities, called T-Bills, from commercial banks. This increases the money supply, since there is more cash in the market. This is called Open Market Operations (or, if you want to be cool, OMO).

Extra credit.

The Fed sells these notes, and then stores the money they are paid with, thereby decreasing the money supply. The Fed can conversely buy these notes back to increase the supply.

Another way they can control the money supply is through quantitative easing (QE), where the Fed not only buys and sells Treasury Bills, called T-Bills (which are short term loan securities), but T-Notes and T-Bonds (which are longer term), and even other assets like stocks and bonds. This method was adopted by the Fed during the 2008 Financial Crisis and again during the 2020 pandemic to stabilize the economy.

Control of the dollar is particularly important, since the dollar is what is called the prime reserve currency. This means that countries have dollar reserves, like they might have gold reserves, since the dollar is so dependable and valuable. Anytime the Fed does anything to the dollar, the rest of the world is also impacted.

As you can see, the Fed has ways to manipulate the money supply, the economy, and the cost of your money. They have a lot of power internationally.

The 2008 Financial Crisis

After the “dot-com” bubble in the early 2000s, the market was looking for something to invest in. So banks made home loans to people who could not pay the loans back. The banks would bundle these mortgages into “mortgage-backed securities”. They would then sell them to investors. Meanwhile insurance companies insured these loans for investors (regulators, of course, gave these securities AAA ratings). Meanwhile the investment banks selling these securities were giving out more and more risky loans—to bundle into securities—to be insured by insurers all with a AAA rating by the regulators! Meanwhile the people taking out the loans were getting closer and closer to defaulting on loans that they could not pay back—which meant that the investors couldn’t get a return—which meant that the insurers had to insure—which meant that the regulators looked real bad. MEANWHILE… the housing market tanked, and everything went haywire.

Extra credit.

When a bank fails in the US, they have the full “faith and credit” of the US Government (and the Federal Reserve in particular) to catch them if anything goes wrong. The Fed’s job is *basically* to keep 2008s from happening. That is the job of every central bank, in a way. But the Fed, remember, is there for everyone around the world.

The Gold Standard and Petrodollars

After World War II there was a big meeting at a place called Bretton Woods, which is a classy resort in New Hampshire. All the US’s allies from WWII were represented.

These men, in their innocent way (*evil laugh*), thought that they could stop wars from ever happening again. They created a group of institutions to “keep us from ever having war again”. These institutions are called the World Bank and International Monetary Fund (IMF). The World Bank lends to countries in order to finance infrastructure and fight poverty. The IMF lends to needy countries who are in danger of revolution or something else bad.

I might add that the US is the biggest payer into the IMF and the World Bank.

Bretton Woods also established the US dollar as the prime reserve currency, and pegged the dollar to gold. It was decided that you could redeem an ounce of gold for every $35.

That was until 1965, when French President Charles de Gaulle decided that he wanted gold reserves instead of dollar reserves. President Nixon was not about to give his gold reserves to a Frenchman (or anyone else). In 1971, Nixon ended the Gold Standard. It is referred to as the “Nixon Shock”.

This is actually a great movie about him called De Gaulle (2020). It is in French with English subtitles, but very very good.

Since the US dollar had to be pegged to something, it was decided by Henry Kissinger (which is a whole other story in and of itself) that the dollar would be pegged to oil.

The way it worked is that Saudi Arabia (and the rest of the OPEC countries) agreed to sell their oil for US dollars. Then countries needed the dollar to buy their oil. This is called the “Petrodollar”.

Hold that thought for now… And now a note on…

Eurodollars

When US dollars are used anywhere outside the US, they are referred to as Eurodollars2. This term came from post-World War II, when the United States was pouring a lot of money into European markets in order to help Europe recover from the war.

Eurodollars, though, are not limited to Europe. The term refers to offshore US dollars around the world. These dollars are not regulated by the Fed, since they are outside the US. This makes them more risky. The interest rates for these dollars are often higher. But, since Eurodollars can, of course, be used in the US, they are valuable.

One important thing to note is that these Eurodollars are actual US dollars, and can be used as such in the United States.

We will come back to the Eurodollars later.

How the Fed Controls the World

But the Federal Reserve has even more power than that, when it comes to the world, and holds in its hand the ability to crush the global economy.

Lots of other countries have central banks like the Fed, which do similar things. For example, you may have heard of Deutsche Bank (the Central Bank for Germany) or the Bank of England (the Central Bank for the UK). The Fed is not only the central bank for US banks, but (since the 2008 Financial Crisis) for other central banks (like Deutsche Bank and the Bank of England). Whenever they need money, they apply to the Fed.

Since the US dollar is the prime reserve currency, it is ubiquitous and dependable enough that any bank in the world will accept it. The Fed provides the financial stability to other financial institutions around the world.

This also means that the Fed has enormous power that can directly affect the financial world. If the Fed were to stop lending to the European Central Bank (ECB) or accepting debt as collateral, it could lead to the collapse of the EU, since they could not pay their debts, and no country would trust them.

Wait… what does “accepting debt as collateral” mean?

Accepting debt as collateral

Sometimes debt is a marketable asset. Dave Ramsey talks about “getting out of debt”, but a responsible, reasonable person can use their debt. Someone who takes a mortgage out (or refinances his existing mortgage) on his house now has usable money that he can spend. A house is not very liquid, meaning it is hard to get money out of fast. If he were to invest that money, he could potentially pay back the loan and have more money. He might buy another house rent it out, then sell it at a profit.

If you are carful, debt can be very useful.

But, before we go any further…

A quick note on US debt:

When the US needs money, they don’t go to the bank and get a mortgage. They instead issue bonds, which are the T-Bills, T-Notes, and T-Bonds mentioned above. The Treasury will then sell these on the open market, thereby funding the government’s projects.

Extra credit.

These debts are used all the time in trading and investing. You might have some in your own portfolio. Banks use these securities (anything that is traded, Treasury Notes, stocks, bonds, etc.) almost like currency.

For example, remember the minimum cash that a bank is required to have at the end of the business day. Sometimes they will borrow money from other banks to replenish their supply. Banks often use securities (often Treasury Securities) as collateral for these loans.

Think of two banks. Bank A has a bunch of securities lying about, Bank B has a lot of cash.

Bank A will essentially sell their securities overnight to Bank B and get the cash they need. Next day, Bank A will buy them back, with some interest. Bank B has the security as collateral overnight, Bank A has the cash it needs overnight. To Bank A, this was a Repo, to Bank B, this was a Reverse Repo.

Repo stands for Repurchase Agreement (don’t ask me who decided that), and is basically a short term loan.

Extra credit.

Remember: Treasury Securities are basically fancy names for National Debt. Other countries do the same thing, and will get repos from the Fed using their own debt (government issued bonds) as collateral. The Italian banks might use Italian debt, the English, English debt, etc.

Another thing repos are used for is to calculate the SOFR rate mentioned above.

So, countries use their debt for collateral all the time.

And with that…

The Eurodollar Market

I said I would get back to the Eurodollars (US dollars circulating outside the US).

One of the biggest exports of the United States is the dollar itself. Almost all transactions around the world are in Eurodollars (US dollars circulating outside the US). The United States (obviously) is the only country that can produce US dollars.

When someone in a foreign country deposits US dollars in their own account at home (making them Eurodollars), the bank is obviously going to loan those dollars out (as the Building and Loan did) which are then borrowed and deposited, which are then borrowed and deposited, and so on. The catch is that none of these banks are insured by the Fed. When there is a bank run, the Fed will not be there (necessarily). Sometimes they do come to the rescue, but that is going to be changing.

Extra credit.

The strong point of the ECB (European Central Bank) is that they have had the ability to create dollars faster than the Fed. This might sound absurd, till you think about the way George Baily’s bank runs. The ECB (and other European Banks) take the Eurodollars (US dollars) on the market and loan them out. But they never actually give any real dollars. They are just figures in a books (kinda like Bitcoin). But is that the way the dollar works? Should the ECB have more control over the dollar than the Fed?

Things are changing…

As I have said, the Fed has been the “lender of last resort” for foreign countries. But the Fed has signaled that this would change. Jerome Powell reasserted in a recent forum meeting with the ECB that the Fed’s job “is to find price stability and maximum employment” for the United States:

Just for reference.

In doing this, he has declared that the Fed is representing the US, and will do anything that will benefit them, even at the expense of others, like the EU. The Fed controls the world by being a monopoly, they can bring down the financial world by consolidating their monopoly (i.e., saying that they will not play ball with the other countries).

The Fed has stopped accepting foreign debt as collateral for loans. They have stopped bailing out the world with US dollars (Eurodollars). This is what will bring down the EU and Davos.

2022 Financial Crisis?

Some of these conditions echo the 2008 Financial Crisis. The ECB makes loans in US dollars (Eurodollars) all the time, and through fractional reserve banking (George Bailey Banking), they essentially make more dollars. But these dollars are not FDIC insured. The ECB trusts the Fed to bail them out if needed.

The ECB is expecting the Fed to catch them if they are not able to bail out their banks.

But the Fed is not there. They are too busy focusing on price stability and maximum employment in the US.

Sounds like America First. Hmmmm…..

Does this mean that Europe is on a similar knife-edge as banks were in 2008?

Interesting…

Back to Petrodollars

At the same time, the Saudis have not been happy with the US over the last few years. They have been straying from using only US dollars for their oil (Petrodollars). China has been convincing other countries to take Yuan (renminbi) for China’s purchases.

Meanwhile Russia has been demanding Rubles or gold for their oil. Ironically, they have Europe paying them Rubles for Russian oil while they are fighting Russia in Ukraine. Tells you how important that war is.

But what happens to the US if they can’t peg their currency to oil?

Also, the United States supplies many countries with military aid. One of these is Saudi Arabia. Will the Saudis be willing to depart from the US dollar if the US threatens to remove aid?

In closing…

Ironically, the banks (the Fed and the big Wall Street banks that own the Fed) created by some of the most globalist elite in history (J.P. Morgan being one), are the ones taking down the globalist agenda of Davos—not out of personal benevolence, but allegiance to Wall Street and US Commercial Banks.

The reality is that there are many opinions about who actually controls the US— whether it is China (the CCP), the City of London, or Davos—however, the US Commercial Banks in the United States have a lot of power. They have the power of the purse, and that is ultimate power in this climate.

The commercial banks installed Jerome Powell as chairman, and they are going to protect their own. This is good for the American people at the moment since the enemy of US commercial banking and the American people is the same: Davos.

The Enemy of my Enemy is my Friend.

I must remind you that I am just an 18 year old young man who is trying to figure things out. I am not a doctor, lawyer, financial advisor, or theologian. I read the doctors, lawyers, financial advisors, or theologians and try to understand what they are talking about, and then write about it. Don’t listen to me! Listen to the people I listen to.

Tom Luongo from Gold Goats n’ Guns and Mark Wauck from Meaning in History are part of the inspiration for this article. Reading their stuff helps me understand what I am talking about:

Note: I am going to be very repetitive on this point, since Petrodollar, Eurodollars, and US Dollars are exactly the same, but refer to different things. Just keep in mind: they are all US dollars, used in different ways!

I love the Lord of the Rings Meme.